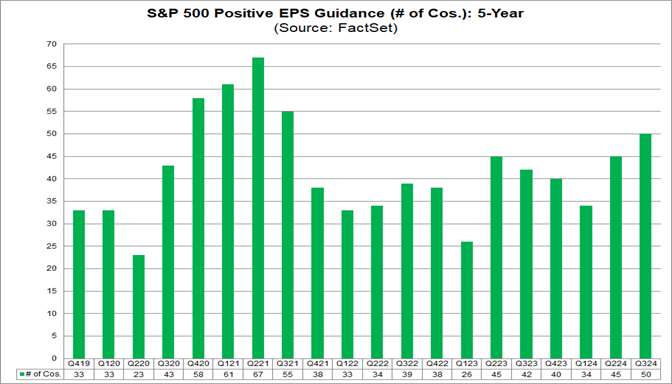

Record optimism in tech as positive EPS guidance surges to three-year high in Q3 2024

In Q3 2024, S&P 500 companies showed a shift in earnings outlook, with 110 issuing EPS guidance: 60 gave negative guidance, while 50 offered positive, according to FactSet.

In Q3 2024, S&P 500 companies showed a shift in earnings outlook, with 110 issuing EPS guidance: 60 gave negative guidance, while 50 offered positive, according to FactSet. But IT stands out as the leader, supported by an increase in its bottom-up EPS estimate in Q3.

Although the number of companies issuing negative EPS guidance exceeds the 5-year average of 57, it falls below the 10-year average of 62. This quarter also marks the lowest number of S&P 500 companies giving negative EPS guidance since Q4 2021. On the positive side, 50 companies issuing favorable guidance represents a sharp uptick, surpassing both the 5-year average of 41 and the 10-year average of 37. In fact, this is the highest number of companies giving positive EPS guidance since Q3 2021.

From a sectoral perspective, the Information Technology sector stands out as the leader. Twenty-five companies within this sector have issued positive EPS guidance, far above the 5-year average of 19.9 and the 10-year average of 16.5. This marks the highest figure for the sector since Q3 2021. At the industry level, Software (8 companies) and Semiconductors & Semiconductor Equipment (7 companies) are leading contributors to the positive outlook within the technology space.

According to Factset, this optimism is reflected not only in company guidance but also in analyst expectations. The Information Technology sector was the only sector to record an increase in its bottom-up EPS estimate (+0.3%) during Q3 2024, further underscoring the positive momentum in earnings projections. With an expected earnings growth rate of 14.9% for Q3, this sector outpaces all other sectors in the S&P 500.

As companies continue to issue guidance in anticipation of their actual results, it's clear that the Information Technology sector is driving much of the earnings optimism for Q3 2024. The increased EPS guidance, coupled with rising analyst estimates, points to a continued upward trajectory for this critical sector.

For more detailed analysis, you can refer to the full FactSet report: Did Analysts Cut EPS Estimates More Than Average for S&P 500 Companies for Q3?