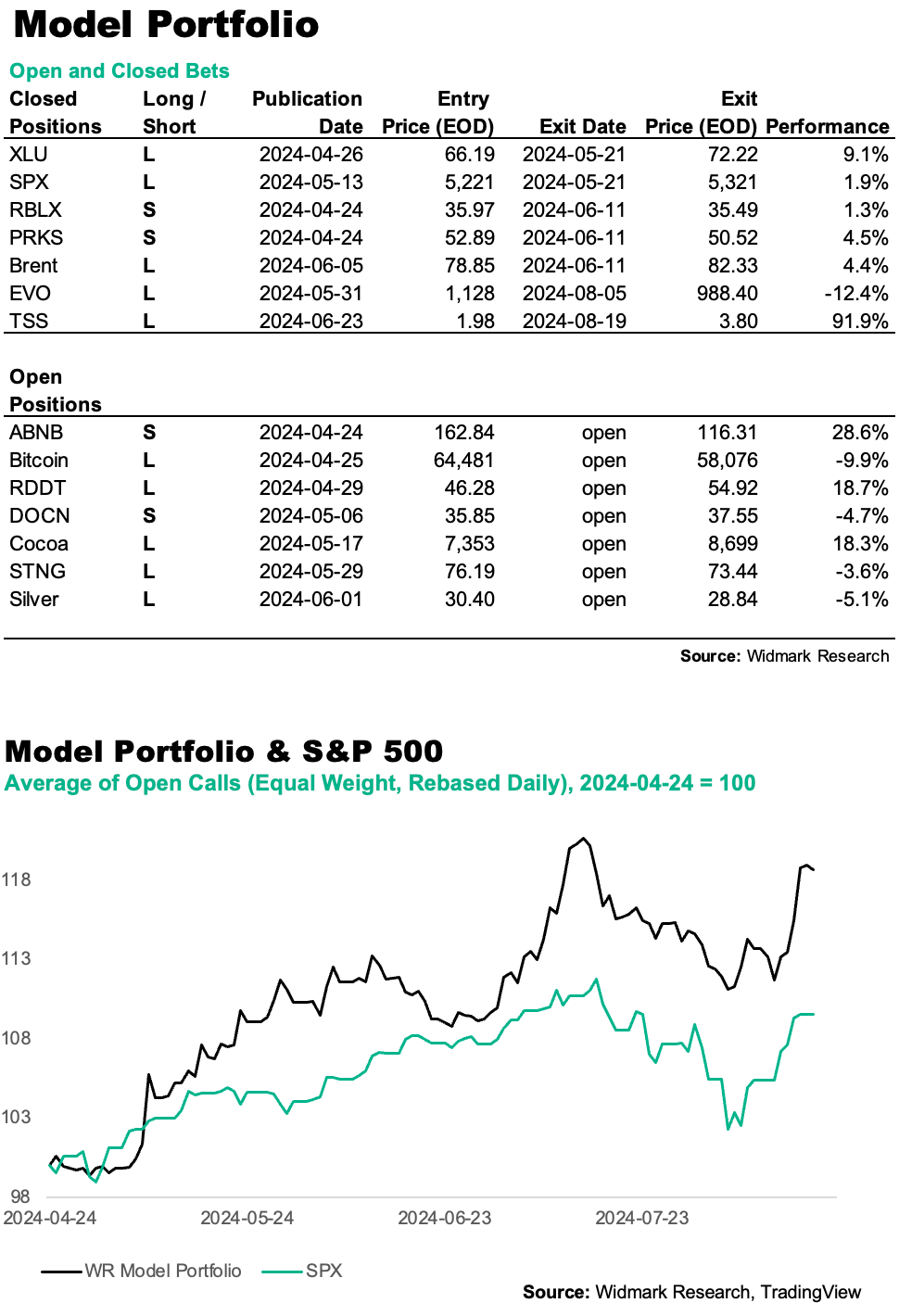

Portfolio Update: Exiting $TSSI After 92% Surge; Portfolio Up 18.7% vs. SPX 9.5%

Over the summer, we maintained our positions despite market volatility, which yielded mostly positive results. As we close our Long position in TSS after a 92% gain, our portfolio stands at an 18.7% increase since April, outperforming the S&P 500.

We chose to hold all our positions over the summer despite the volatility. This strategy has both paid off and not, with a slight lean towards the positive.

We are now closing our Long position in TSS ($TSSI) after a second parabolic surge, with the stock up 92% since our entry in late June. In our opinion, the stock is now disconnected from any form of fundamental support.

We also got stopped out of our long position in Evolution ($EVO) at SEK 1,000, as we had set when we made our entry in late May, resulting in a 12.4% loss (SEK 988, as we use End of Day prices to register performance).

Additionally, we added to our position in Scorpio Tankers, as we announced we would when we made our call on the stock on May 29, after it dropped below $72.

We've also endured a pretty severe blowback in Digital Ocean, which rallied on the general recovery for the Nasdaq. As we are Short, our position in DOCN is now down 4.7%. We'll keep a close eye on DOCN and stop out if we don't get a pullback before $39.

Out best performing open position is ABNB (up 29%) which has not participated in the general market bounce, and Cocoa (up 18%).

The portfolio is now up 18.7% since inception in April, with an annualized Sharpe Ratio of 2.4, compared to the S&P 500, which is up 9.5%. We are currently on the lookout for new high-conviction calls and hope to share these with you soon.