Model Portfolio Update: Up 7.5% since inception: 2.6ppt ahead of SPX

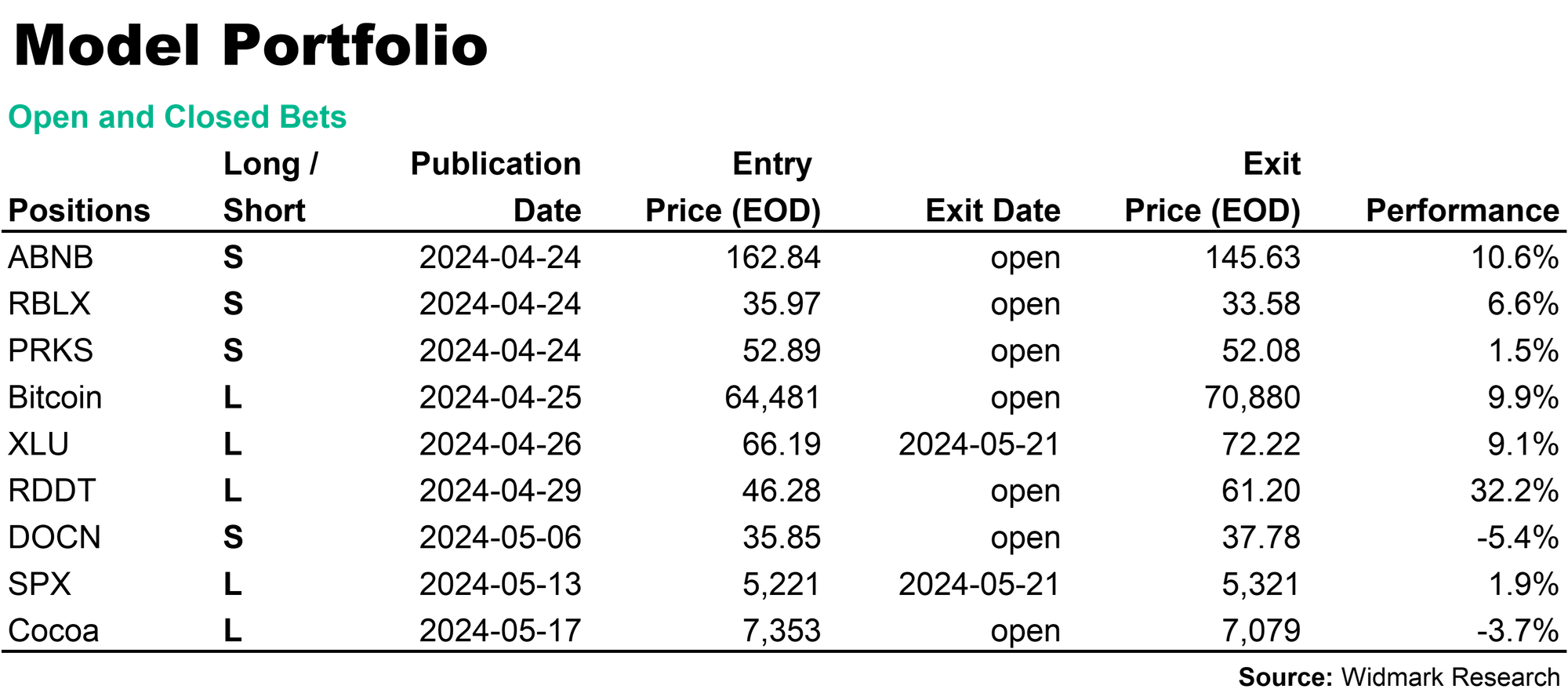

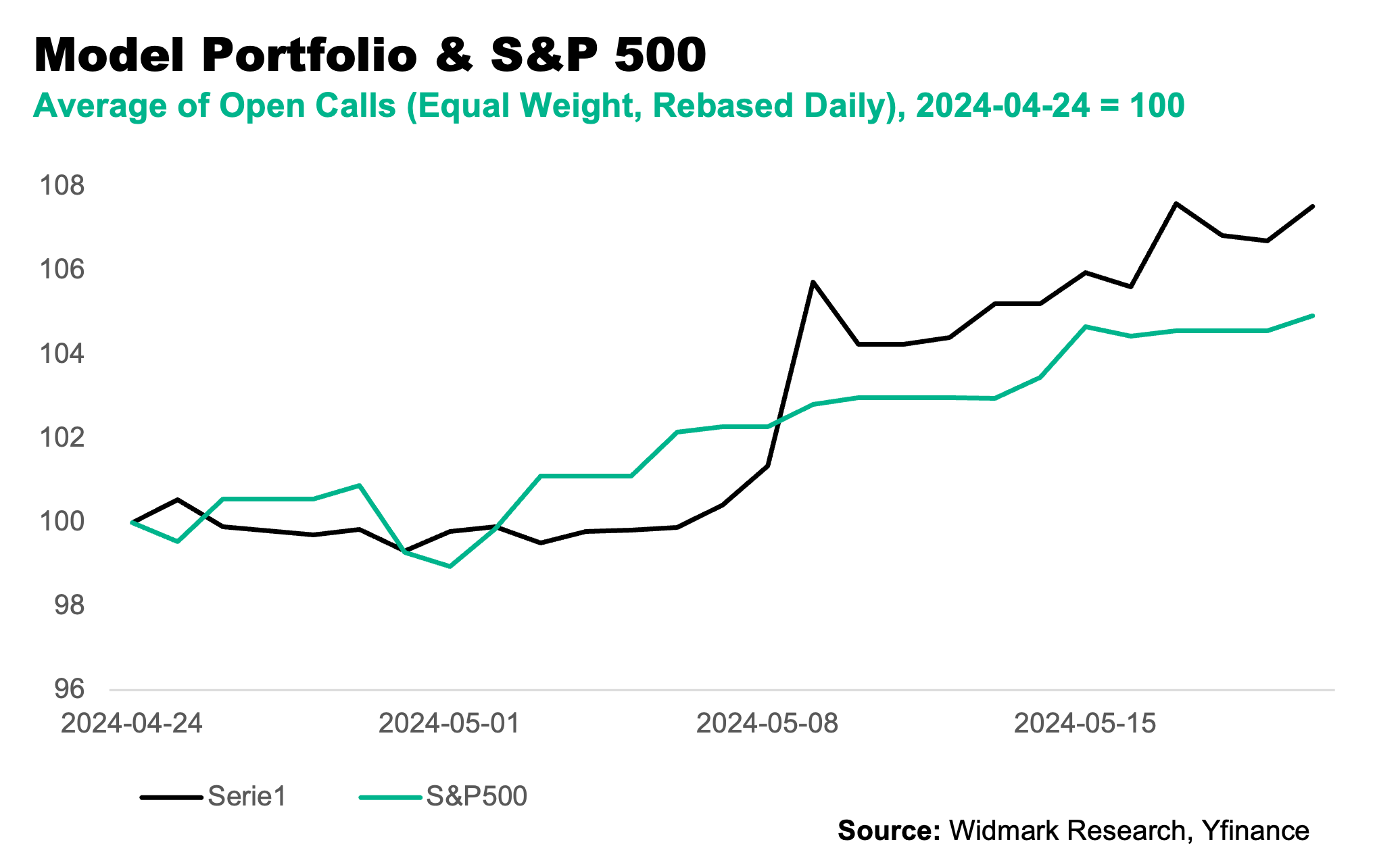

To track our open calls, we use a Model Portfolio for performance, closing positions, and reviews. Since April 24th, the portfolio is up 7.5% vs SPX's 4.9%. Our strongest bet is Reddit Long, up 32%. We close positions in XLU and SPX.

To make it easy to follow up on our open calls we use a Model Portfolio to track performance. This is also where we close open positions, and review positions. Performance is calculated as the average daily performance of all our research bets. All bets are equal weight, and rebased daily. For fairness, we calculate performacne based on End of Day prices on the day of publication.

Since our first public bets in this setup on April 24th, the portfolio is up 7.5%, which compares to SPX rise of 4.9% in the same period.

Review of Open Trades and two exits

Since inception, our Long in Reddit has been the strongest contributor to performance, up 32% since publication on April 29th. This will soon warrant a review about the momentum and further revaluation potential.

Other strong performers have been Short bets in Airbnb and Roblox which both saw big drops on their respective Q1 reports.

Our most recent bets on a Short in Digital Ocean and Long Cocoa has not yet played out.

Our Long bet in Utilities have contributed 9.1% in less than a month, and while we do see further upside from here, we find it likely that Utilities will take a breather and now close our position, bagging that performance.

We also close our Short term trade call in SPX after a 100 point run, contributing 1.9% in eight days.

Open bets

After closing XLU and SPX, more than half, 4 out of 7 open bets, are now Short.