RESEARCH

Huge blind spot risk to the EV market

With copper surging above $10,000 per tonne, there’s $140-680 literally dangling up for grabs, in places where no one is watching at night. All solutions to this problem will come at tremendous cost.

RESEARCH

With copper surging above $10,000 per tonne, there’s $140-680 literally dangling up for grabs, in places where no one is watching at night. All solutions to this problem will come at tremendous cost.

RESEARCH

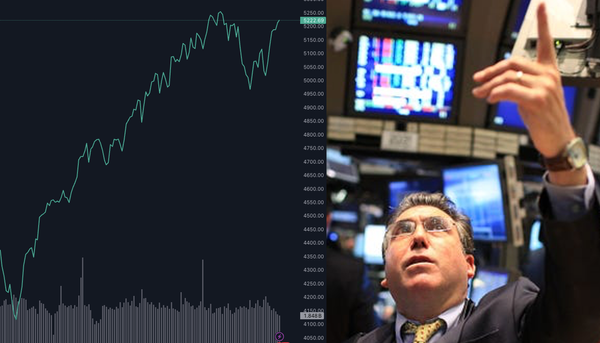

Despite a more mixed macroeconomic picture, we see five factors that offer robust support for new ATHs on the SPX in the near future.

DATA & TOOLS

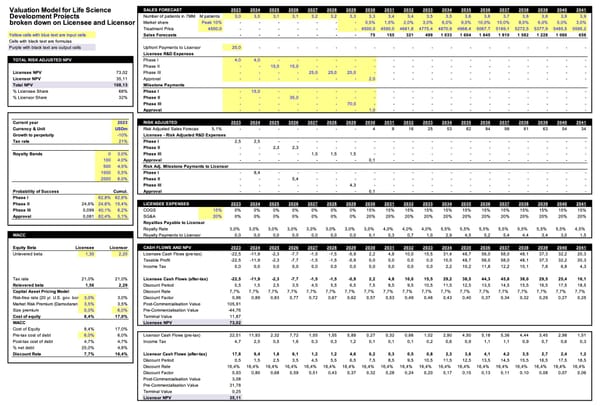

This biotech model generates risk-adjusted values broken down on both licensor and licensee. 💊💉🔬🧬🧪

COMMISSIONED EQUITY RESEARCH

Read More Read Less

COMMISSIONED EQUITY RESEARCH

Read More Read Less

SHORTS & FRAUDS

Despite strong industry tailwinds, key executives continue to jump ship as declining retention rates persist. Addressing this will likely require significant investment. Coupled with modest ARPU and slowing ARR growth, this warrants a soft sell approach.

COMMISSIONED EQUITY RESEARCH

Read More Read Less

RESEARCH

While a small niche player in social media and not yet profitable, Reddit boasts a unique platform, high gross margins, outsized growth among high-value US users, and a strong focus on improved monetization. These factors should drive a closing of the gap to peers.

RESEARCH

In the past month, the Utilities sector (XLU) have outperformed the SPX by nearly 8ppt. Now, three of the top 15 companies have reported for Q1, showing that the Utilities sector are at a crossroads.

RESEARCH

While there is mounting evidence pointing to an imminent devaluation of the Chinese CNY, it is surprisingly hard to get exposure to such an event after the ETF CYB was discontinued in 2023. Here are two ways to play it.

COMMISSIONED EQUITY RESEARCH

Read More Read Less

SHORTS & FRAUDS

Essential to long-term success is avoiding the meltdowns. Here we list potential shorts and frauds, and their key issues. Feel free to hit me up with your best short idea and maybe we'll add it to the list. We update this list continuously.

OSINT

This week, we note NatGas contango, oil backwardation softening, early reporting season EPS surprise and the Middle East holding its breath in anticipation of Israel's response.

COMMISSIONED EQUITY RESEARCH

Read More Read Less

SECTORS & THEMES

With equities taking a breather, commodities are picking up steam, led by Crude, Copper and the whole Agri spectrum. This is likely to drive a rebound in inflation. Here are two ways to play it.

COMMISSIONED EQUITY RESEARCH

Read More Read Less