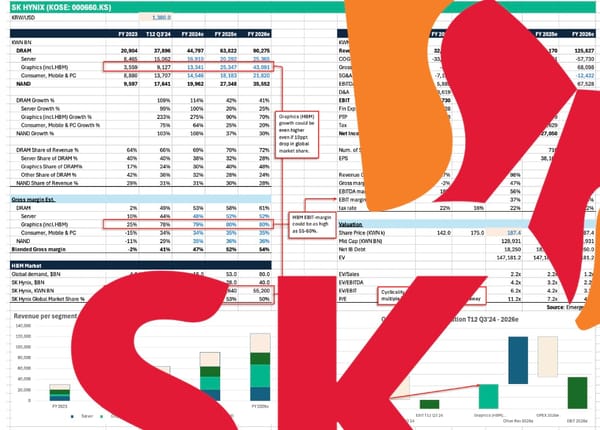

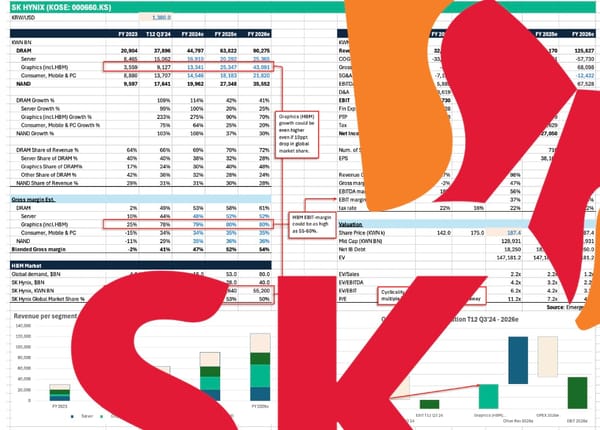

AI boom about to create bottleneck in HBM chips, where Nvidia's supplier SK hynix holds a 60% market share. Here’s how it will triple earnings

This will result in mid-single-digit P/E by 2025-26e. Here’s how.

This will result in mid-single-digit P/E by 2025-26e. Here’s how.

Q3 Sales and Profits beat estimates, but the economic downturn affects demand. In 2025, we assume an economic recovery leading to a double- digit underlying profit growth. We expect dividend policy payouts each year in 2024-26.

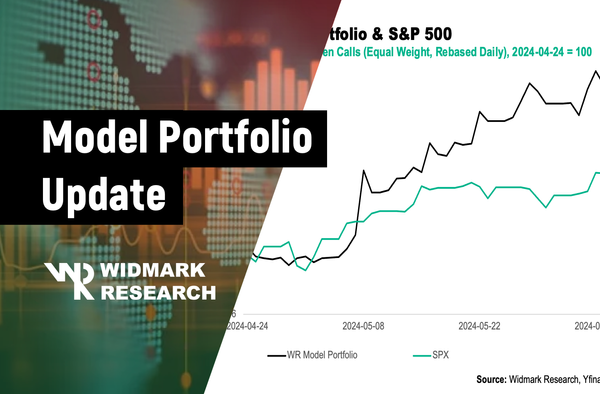

Model Portfolio now up 28% vs SPX at 17%. Adding SK Hynix as HBM chips are next in line to benefit from AI's explosive growth. With a strong market lead and high margins, SK Hynix is positioned for growth.

While AI has driven rapid gains in semiconductors, its impact on the real economy is lagging, especially in biotech. Here, we present an equal-weighted basket of seven biotechs, up 38% in the past year, including Alnylam and Sarepta, expected to benefit from AI in 2025.

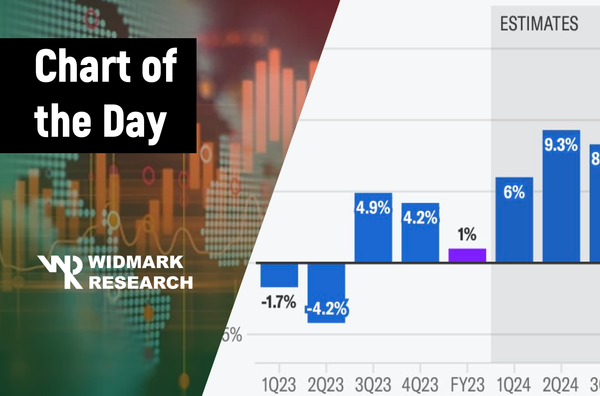

In Q3 2024, S&P 500 companies showed a shift in earnings outlook, with 110 issuing EPS guidance: 60 gave negative guidance, while 50 offered positive, according to FactSet.

Are you like me, thinking you're too clever and alert to fall for advanced hacking schemes? Think again. Here’s how hackers use sophisticated tactics to slip malware past even the most cautious users—and what you can do to stay safe.

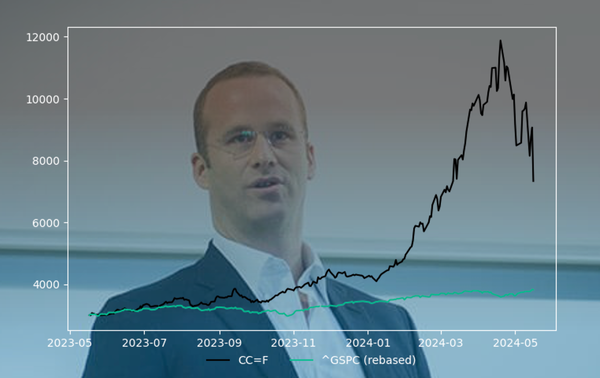

After near-total failure 15 years ago, Carbon Capture and Storage (CCS) is once again being hailed as the climate saviour. However, recent research published in Nature reveals sobering insights—this technology, still in its infancy, is unlikely to scale in time to meet climate goals.

Read More Read Less

Scanning for stocks with a market cap above $2 billion, a FCF margin +5%, and a YTD drop of 40% (60% since peak in May), Celsius Holdings (CELH) quickly stands out. But what are CELH's real growth prospects, and how much of growth deceleration is priced in?

Read More Read Less

Read More Read Less

Read More Read Less

Read More Read Less

Read More Read Less

Over the summer, we maintained our positions despite market volatility, which yielded mostly positive results. As we close our Long position in TSS after a 92% gain, our portfolio stands at an 18.7% increase since April, outperforming the S&P 500.

With Dell commissioned to construct a massive supercomputer for xAI in Memphis, this initiative is poised to benefit the entire ecosystem of suppliers in the region. Here is our top pick offering asymmetric return potential.

CHART OF THE DAY

Bitcoin and the Nasdaq are sending conflicting messages about risk appetite and only one of them is telling the truth.

CONTEXT

If the forthcoming Superintelligence can give a decisive military advantage, how likely is it they will let you use if for stuff other than making memes, sending cold emails and some basic programming?

GEOIMPACT WATCH

What happened at the OPEC+ meeting and what bearish factors could pressure crude in H2'2024? Video session with Dimitri Zabelin, founder of Geopolitics Strategy research firm Pantheon Insights.

MODEL PORTFOLIO

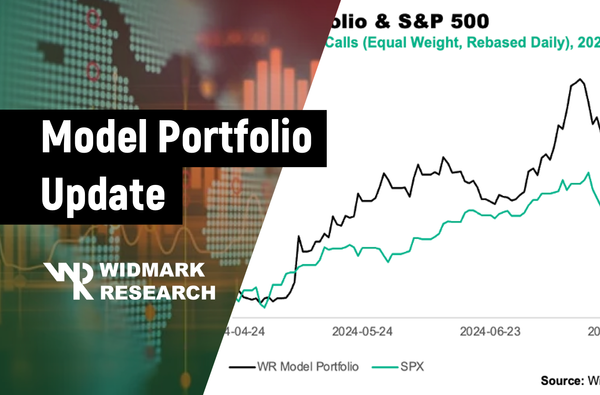

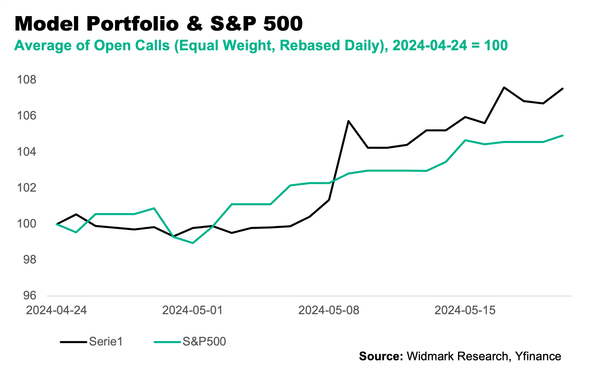

We close our positions in RBLX, PRKS and Brent. The Model Portfolio is now up 11.6% since inception on April 24th, compared to the S&P500 up 5.3% in the same period.

RESEARCH

Oil prices have dropped over 9% in the past five days due to fears of increasing supply from OPEC+ and weakening global demand. Conversely, geopolitical unrest is growing as Brent crude has reached an important technical level.

RESEARCH

With industry-driven demand projected to outpace a structurally declining supply by 21% in 2024, silver is poised for a parabolic move.

RESEARCH

Despite recent growth deceleration, EVO's dominant position in live casino, stable margins, and strong cash generation present a compelling opportunity amidst a sharp stock pullback. With the price now at a key support level and favorable technical indicators, we anticipate a +20% rebound.

MODEL PORTFOLIO

Since its inception on April 24th, the Model Portfolio has achieved a strong start, outperforming by 6.5 percentage points over SPX. Here is a brief rundown of the top contributors.

RESEARCH

With surging geopolitical tensions and years of deleveraging, Scorpio Tankers is primed to gain, now heading for over $1B in CF in 2024. But after a 70% rally, timing is tricky.

CHART OF THE DAY

The OZEM ETF hopes to bank on the mega success of the miraculous weight loss drug, and the list of holdings should be fertile ground for stock pickers looking for a more direct ride on the wave.

CHART OF THE DAY

Q1 2024 sets the stage for accelerating earnings growth throughout the year.

GEOIMPACT WATCH

Since a large part of the stock market's recent gains rests on the semiconductor industry, where Taiwan is a key player, we take a look at the downside risk here. And it's huge also for the West.

RESEARCH

A booming copper price signals a strong economy, now largely driven by secular factors like the energy transition. To weed out the plain-vanilla cyclicals from the secular growth driven industry stocks, we make a case for Momentum ETF PRN over SPDR Industrial ETF XLI.

MODEL PORTFOLIO

To track our open calls, we use a Model Portfolio for performance, closing positions, and reviews. Since April 24th, the portfolio is up 7.5% vs SPX's 4.9%. Our strongest bet is Reddit Long, up 32%. We close positions in XLU and SPX.

COMMISSIONED EQUITY RESEARCH

Read More Read Less

RESEARCH

Despite a 40% pullback in the parabolic cocoa rally, hedge fund manager Pierre Andurand believes cocoa has another leg up to go. Several structural factors with near-term impact, combined with a 10-year replant cycle and a technically appealing setup, suggest he will likely be right.