NANEXA: Focus on dual GLP-1 opportunities and the partner projects

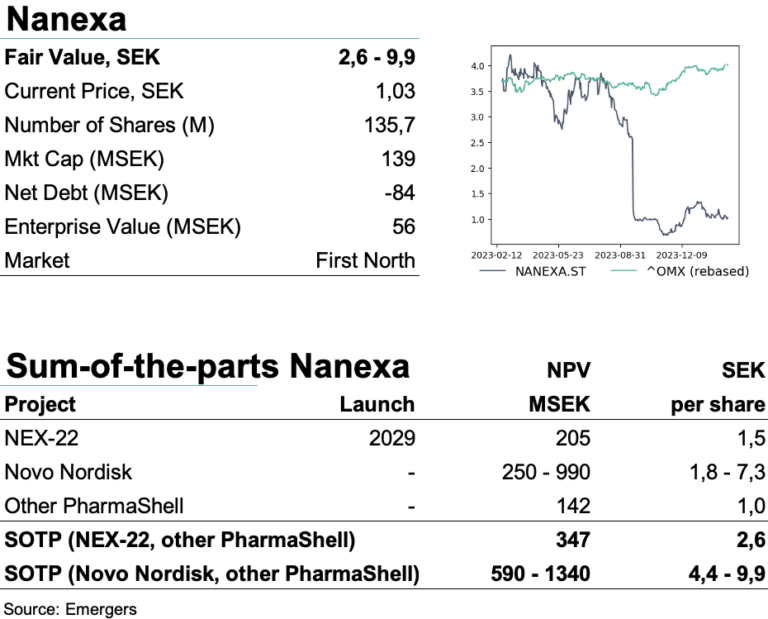

Apart from a write down of capitalized development related to the suspended projects NEX-18 and NEX-20, there was not much new in Nanexa’s full year report. Following the streamlining of its activities, stemming from the outcome of the rights issue in December 2023, Nanexa now focuses on the projects most likely to generate near-term revenue and thus reduce the need for further external financing. We now look forward to the start of Phase I with NEX-22 in H1’24, as well as the outcome of the partner project with Novo Nordisk and other advanced evaluation projects, including the recent agreement for monoclonal antibodies for a Big Pharma company. All in all, we continue to find support for a fair value of SEK 2.6-9.9 per share.

Write down of NEX-18 and NEX-20 capitalized development

The report for Q4’23 did not reveal any news compared to the streamlining announced in late December after the rights issue. Turnover in Q4’23 amounted to SEK 6.8m, attributable to evaluation agreements (SEK 1.7m) and the deferred revenue from the Novo Nordisk deal (SEK 5m). Along with a SEK 49.5m write-down of capitalized development related to the suspended projects NEX-18 and NEX-20, EBIT amounted to SEK -51.4m. Should Nanexa find the cash and bandwidth to resume either of the suspended projects, the capitalized development would then be activated again on the balance sheet. Net cash amounted to SEK 65m, which with the heightened cost focus is now expected to finance operations into mid-2025.

Phase 1 with NEX-22 next big step

The three focus areas that will be prioritized going forward are

• The own project NEX-22: A one-month depot of the GLP-1 substance liraglutide, within the large and very expansive type 2 diabetes indication. Nanexa is now targeting the start a clinical phase I study with NEX-22 in Q1’24, which might be delayed into Q2’24, with expected read-out by the end of 2024.

• The partner project with Novo Nordisk: The exclusivity and evaluation agreement covers Nanexa’s drug delivery system PharmaShell together with a specific substance class, not yet announced.

• Other well advanced partner projects where Nanexa sees opportunities for interesting broadening of collaborations with significant revenue potential during the period.

Wide range of potential outcomes

With a cash position of SEK 65m at the end of Q4’23, the recent reprioritization will extend the company’s runway into mid-2025. But we continue to note an elevated pressure on the company to reach some form of licensing agreement soon. Based on our SOTP for NEX-22, the Novo Nordisk project and the PharmaShell evaluation delas, we continue to find support for an rNPV of SEK 2.6-9.9 per share. This wide range reflects the wide range of potential outcomes for the company’s various projects and partnerships. We now look forward to the Phase I trial with NEX-22 and more positive news flow from the partner projects as triggers in 2024.