Model Portfolio up 28% (vs SPX 17%) on strong $RDDT and Silver - now adding SK Hynix on surging HBM chip demand

Model Portfolio now up 28% vs SPX at 17%. Adding SK Hynix as HBM chips are next in line to benefit from AI's explosive growth. With a strong market lead and high margins, SK Hynix is positioned for growth.

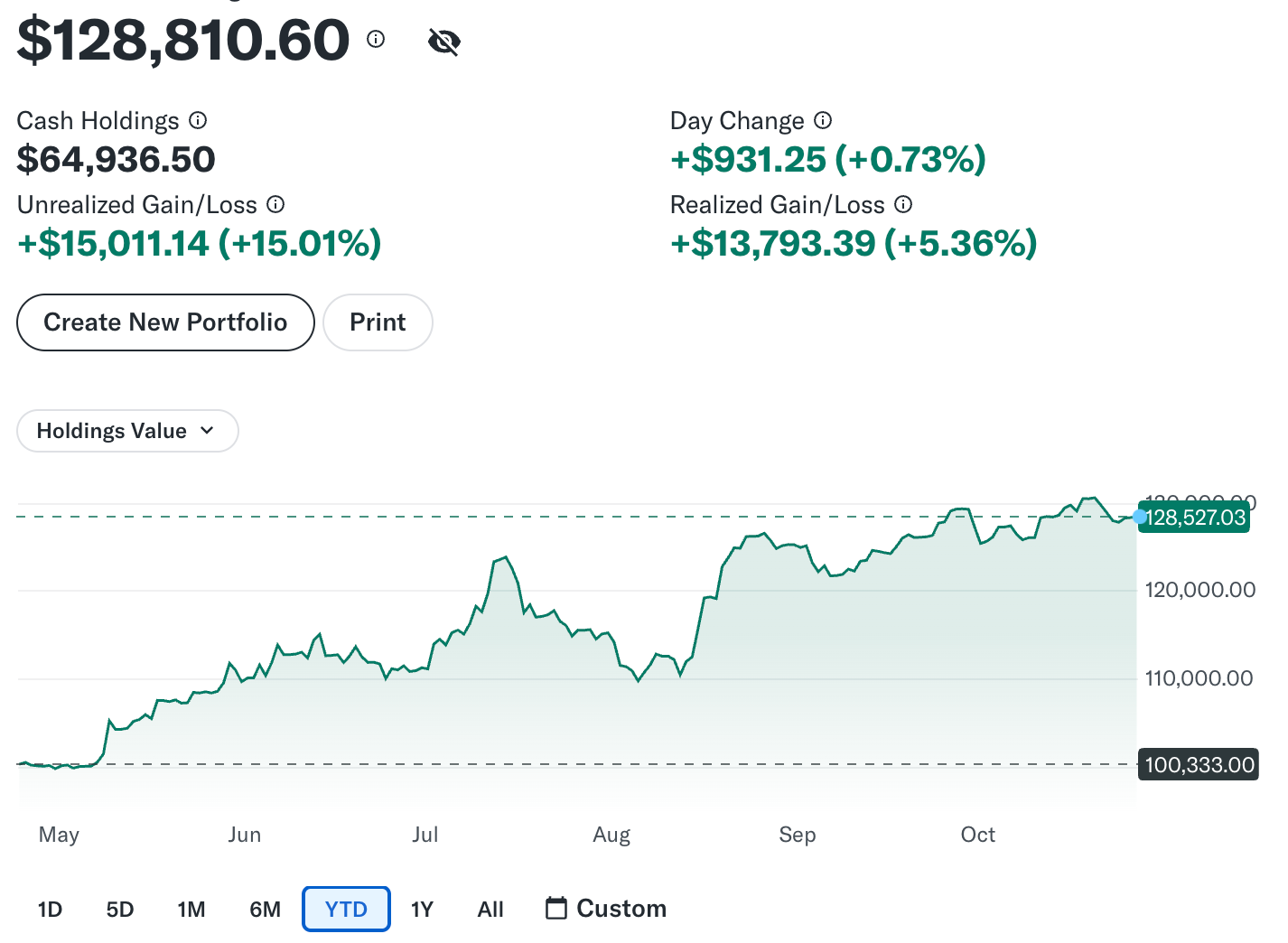

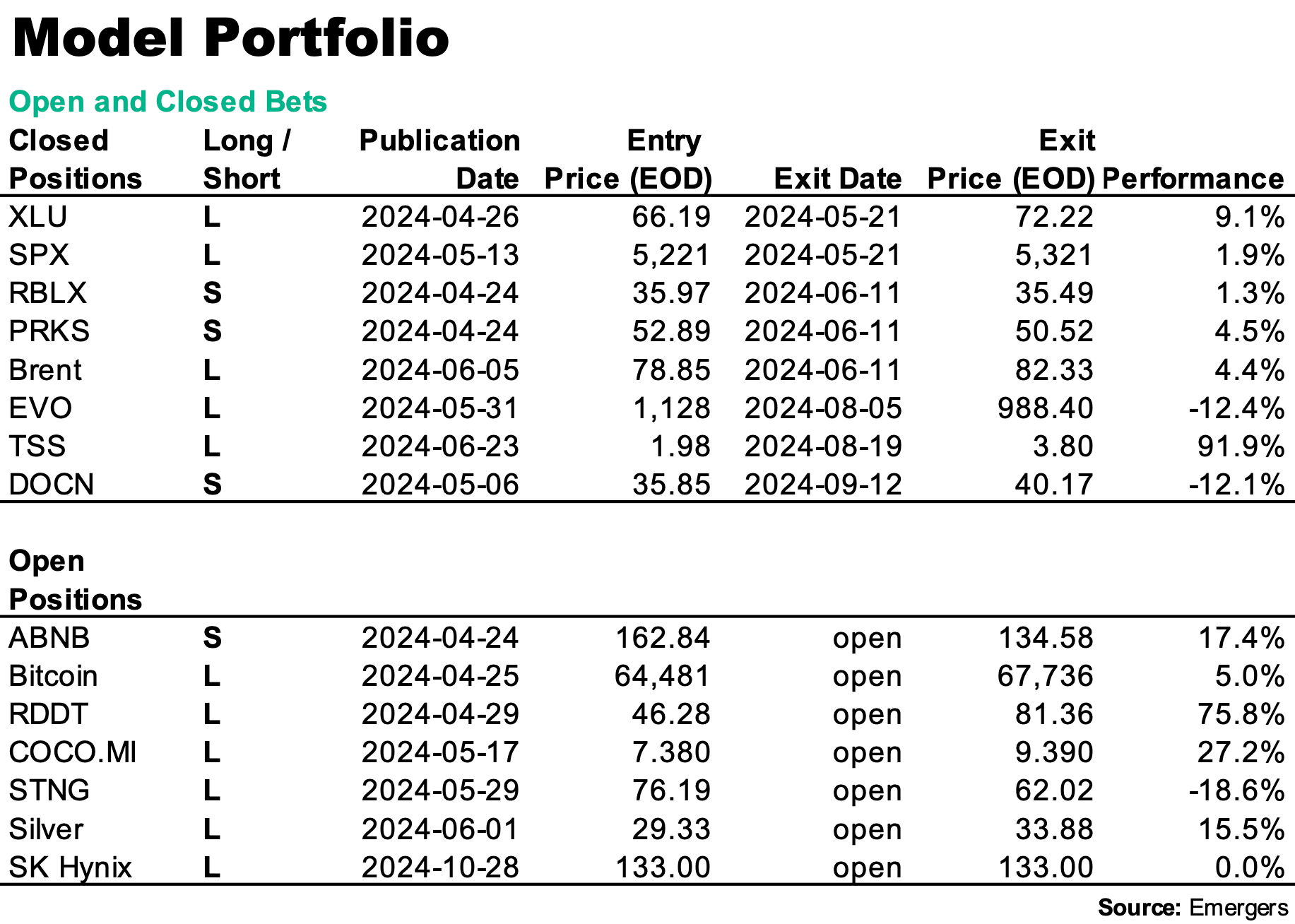

Since starting our Model Portforlio (under the Widmark Research brand) in April 2024, the portfolio is now up 26.5%. A big part of performance came from the long position in $TSSI which we closed (too early) on August, 19th.

The 92% performance in less than two months for $TSSI seemed like a good exit at the time, but we left another 80% on the table. Strong performance in Bitcoin, Reddit and Silver in the past month however, has made up for some of that.

Starting off with $100,000 in April 2024, portfolio is now up 28%, outpacing the SPX at 17% in the same period.

Adding SK Hynix on strong HBM demand

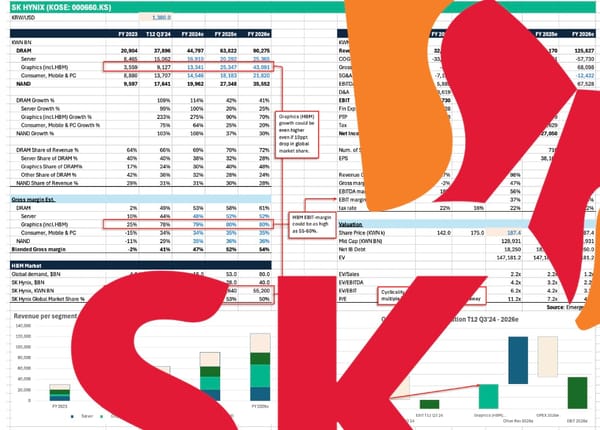

SK Hynix, a leading memory chip manufacturer, stands to benefit significantly from the demand for High Bandwidth Memory (HBM), a specialised, high-performance memory technology crucial in AI and data-heavy applications as it can store and release the data quickly. SK Hynix controls 60% of the global market for these specific nisch memory chips, and over 90% for HBM3, the most advanced version. As AI and machine learning models grow in complexity, demand for HBM, which offers faster processing and lower power consumption, has surged.

SK Hynix is one of only a few companies capable of producing HBM at scale, giving it a unique competitive edge. Additionally, HBM’s integration into high-end GPUs, used by firms like NVIDIA, strengthens SK Hynix's market position. With sustained growth in AI and cloud services, HBM demand is projected to keep rising, supporting SK Hynix’s revenue. Margins for HBMs are also five times those of regular memory chips.

The share now trades at less than 6x NTM consensus P/E and 11x NTM consensus P/FCF.

We now go long SK Hynix (Stuttgart listing HY9H.SG), using Monday's closing price to record Model Portfolio performance.

Disclaimer: This is not personal advice or recommendation to invest in any securities. Past performance does not guarantee future results. Investing in biotech stocks involves risks, including potential volatility and the possibility of losing your capital.