Supply-demand dynamics show all ingredients for a surge in Silver

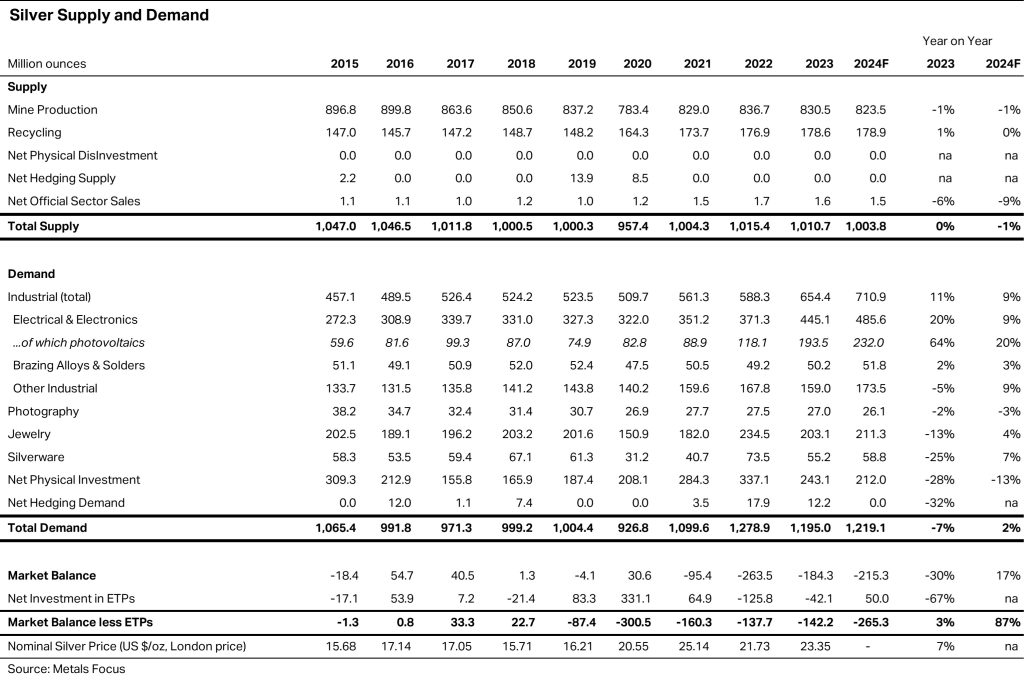

With industry-driven demand projected to outpace a structurally declining supply by 21% in 2024, silver is poised for a parabolic move.

Commodities, and particularly Copper and Gold, are all the rage right now. But the one that presents the most interesting opportunity is Silver. Here we find limited and even falling supply paired with structurally higher demand, which is a perfect recipe for a major price surge. Here we go through the details of both sides, and also the compelling technical price picture.

Demand side recovering in 2024

It is universally recognized that Silver is in a structural deficit, driven by the boom in solar capacity across the world, where Silver is a key ingredient, and the growing trend of electronics being embedded in everything that we do, and particularly in vehicles. Against that backdrop, the market is headed for a fourth year in deficit, with this year’s shortage seen as the second biggest on record. According to the Silver Institute, demand will outpace supply by a stunning 21% in 2024.

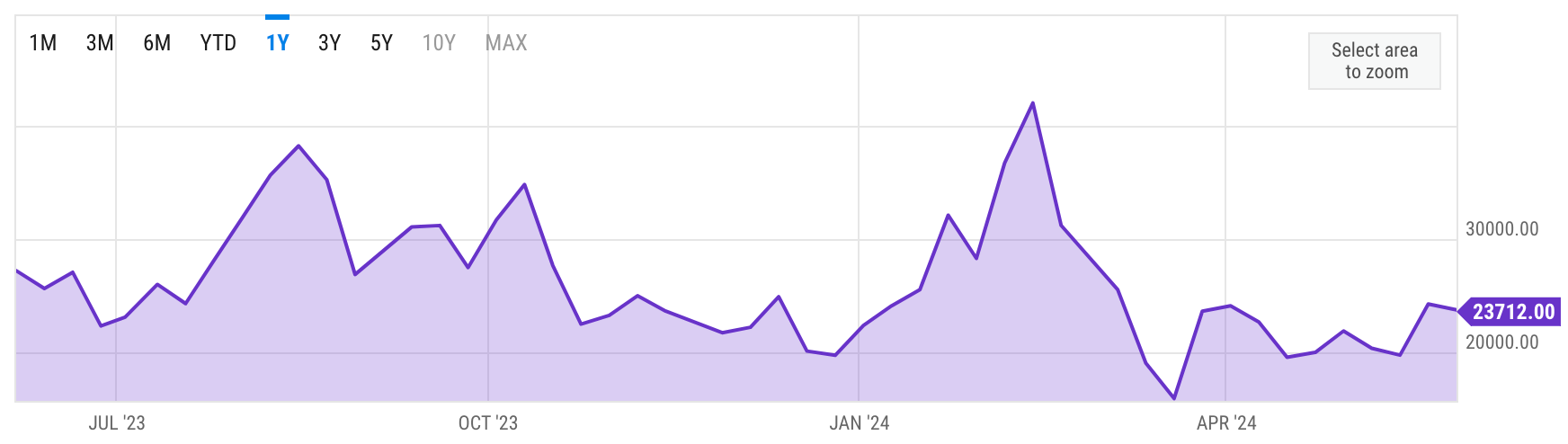

Looking just at industrial demand, it is set to rise 9% this year, after an 11% increase in 2023. That has led industrial users — which in a balanced market would rely on miners for supply — to drain the world’s major inventories. Stockpiles tracked by the London Bullion Market Association fell to the second-lowest level on record in April, while the volumes at exchanges in New York and Shanghai are near seasonal lows. At this pace, the LBMA stockpiles would be depleted over the next two years.

It's also worth noting that available volume could be overstated as it includes holdings in ETFs. In addition, with the price starting to move, the Silver theme is now gaining traction among physical and financial investors.

Supply side no better

Silver is primarily mined as a byproduct of lead and zinc mines, of copper mines and of gold mines, and there are very few companies that mines silver specifically. This means that the structural underinvestment into the general mining space has resulted in this structural undersupply of silver.

Until recently, the supply-deficit has been mitigated by significant amounts of above-ground inventories that could be relied upon to balance gaps in silver markets, but that is now about to change.

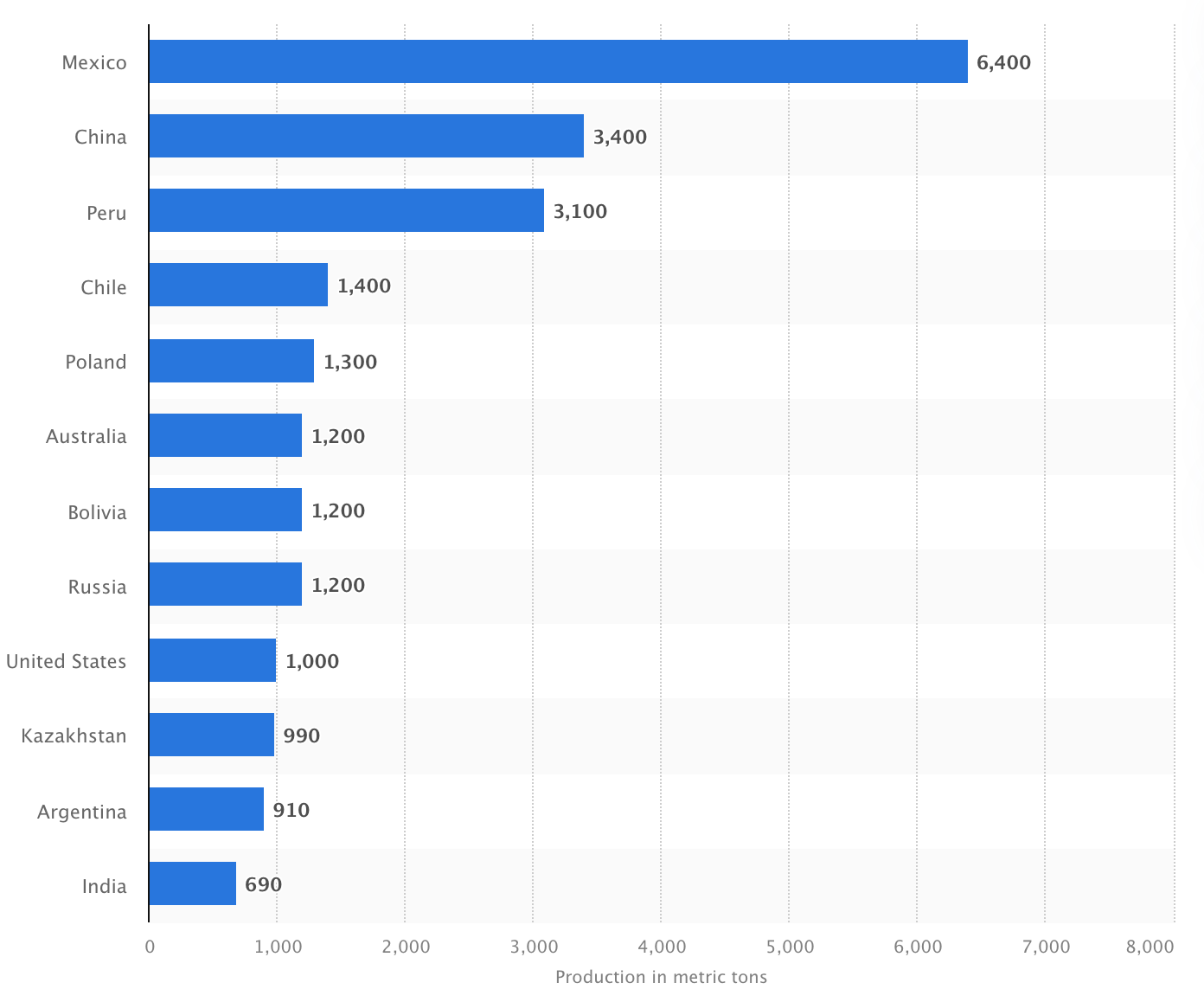

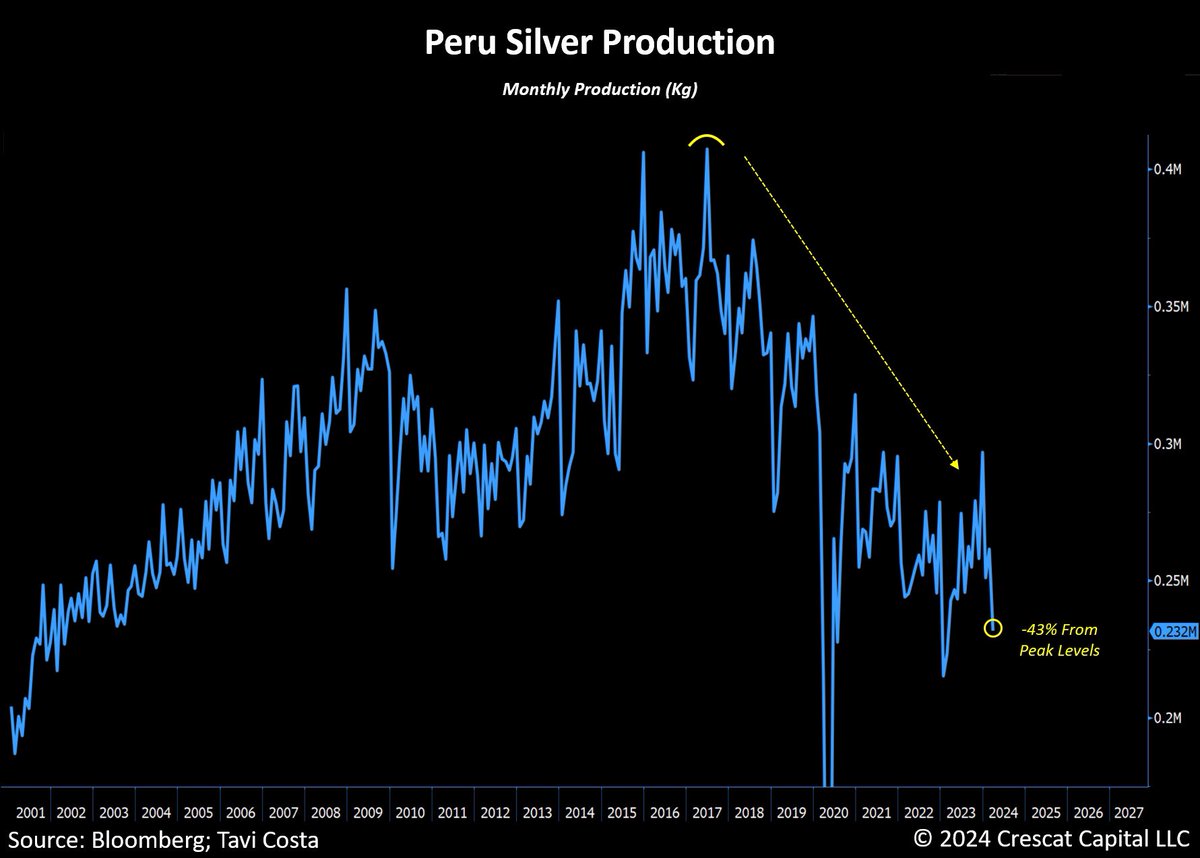

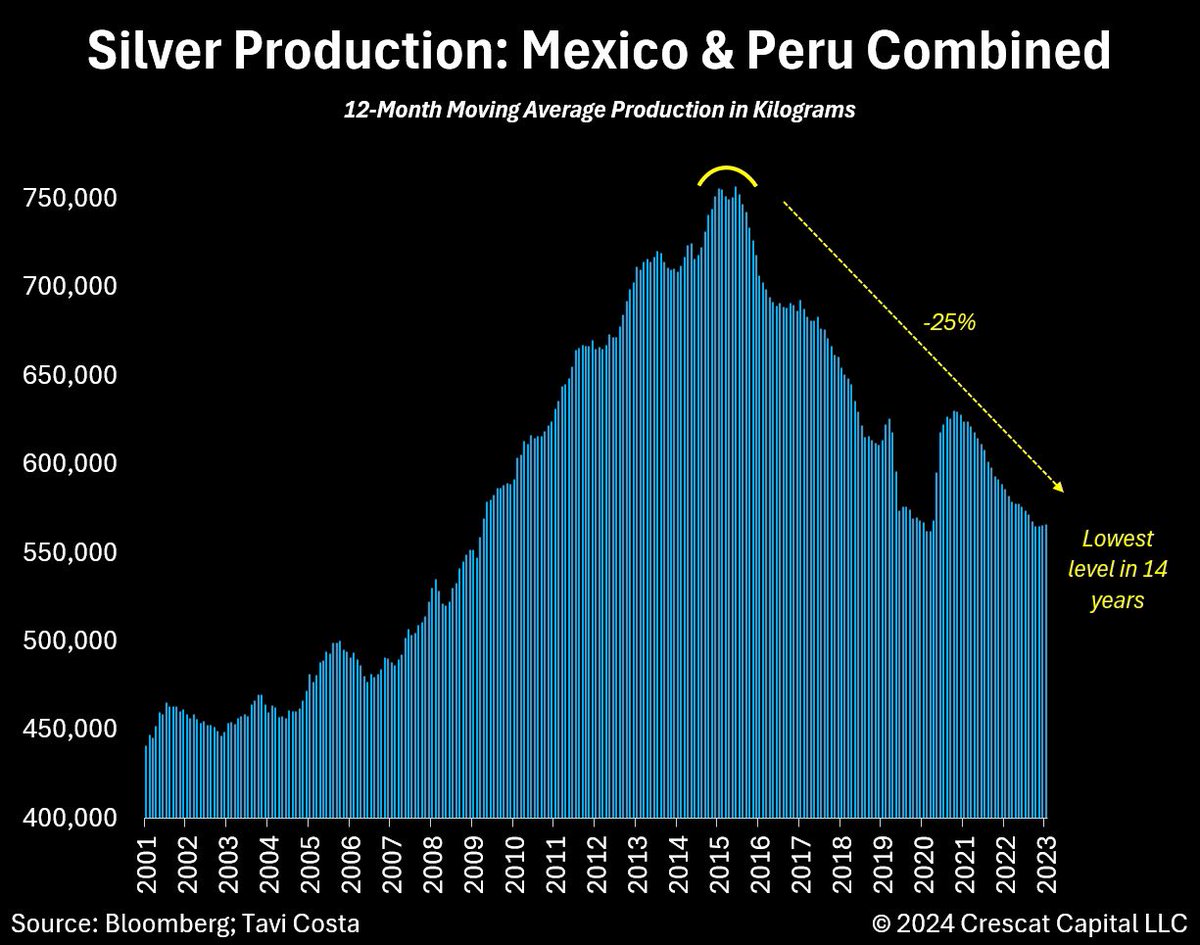

After Mexico, at 6,400 tonnes per year, China and Peru are the second and third largest producer. However, silver production in Peru has continued to fall severely, down 43% from peak levels in 2017.

Same goes for Mexico. In Mexico and Peru combined, production is down 25% from 2016 peak levels.

Compelling technical picture

It currently takes about 77 ounces of silver to buy 1 ounce of gold, compared with the 20-year average of 68. Back in January, the gold-silver ratio was above 90, the most stretched since September 2022.

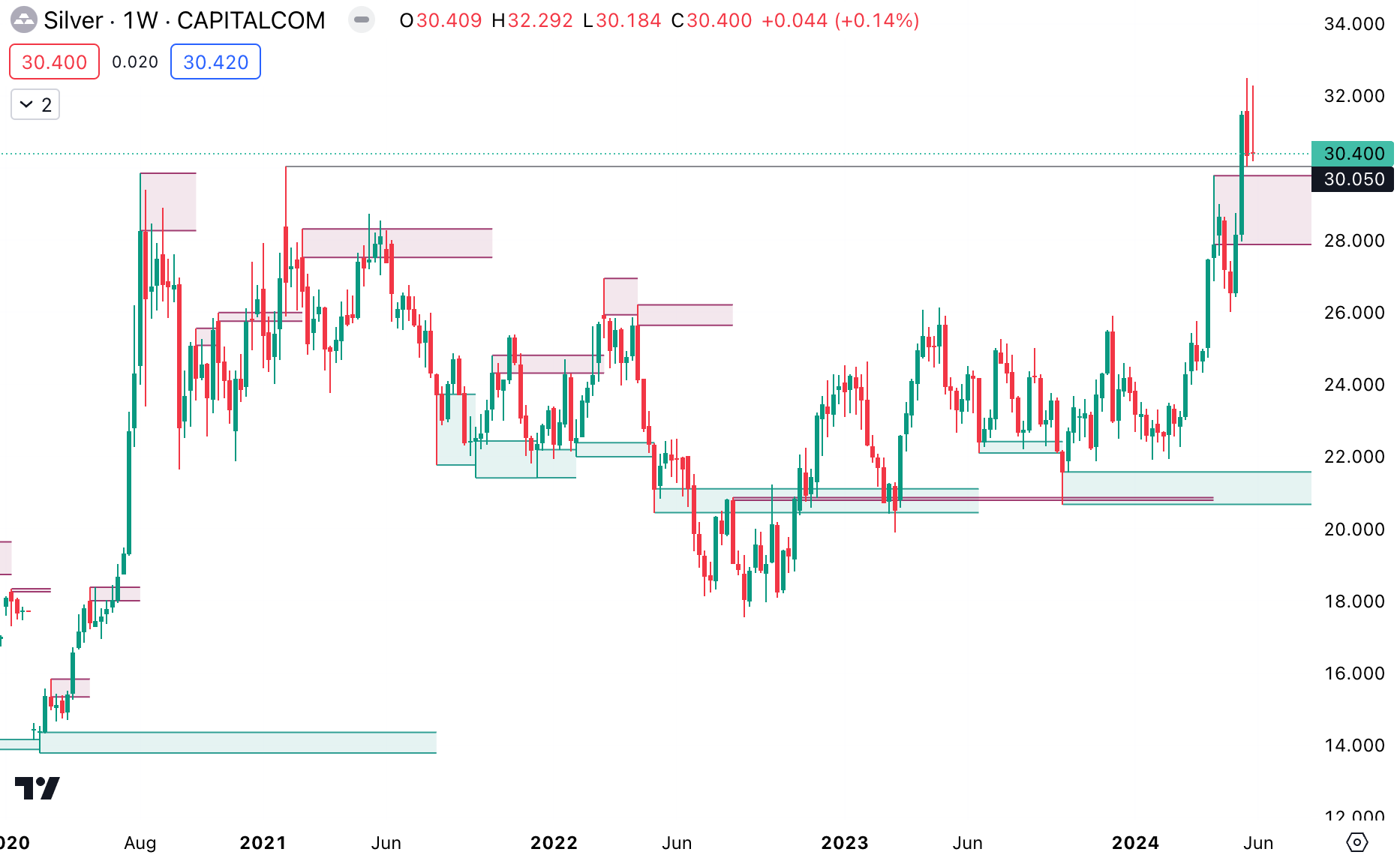

In spite of a pullback during last week, Silver just recorded a monthly close above $30, right above the $28-30 support zone.

Interestingly, COMEX Managed Money Short positions in Silver are around the same level they were at the beginning of the year.

It's hard to put a target to this, as we expect that this will play out in a squeeze causing a parabolic move in Silver. While we expect the $28-30 level to hold, we can see price moving down to test the $25-26 level, which we would consider a phenomenal buying opportunity. But we prefer to board the Silver train here, at the $30 level to not miss the move.