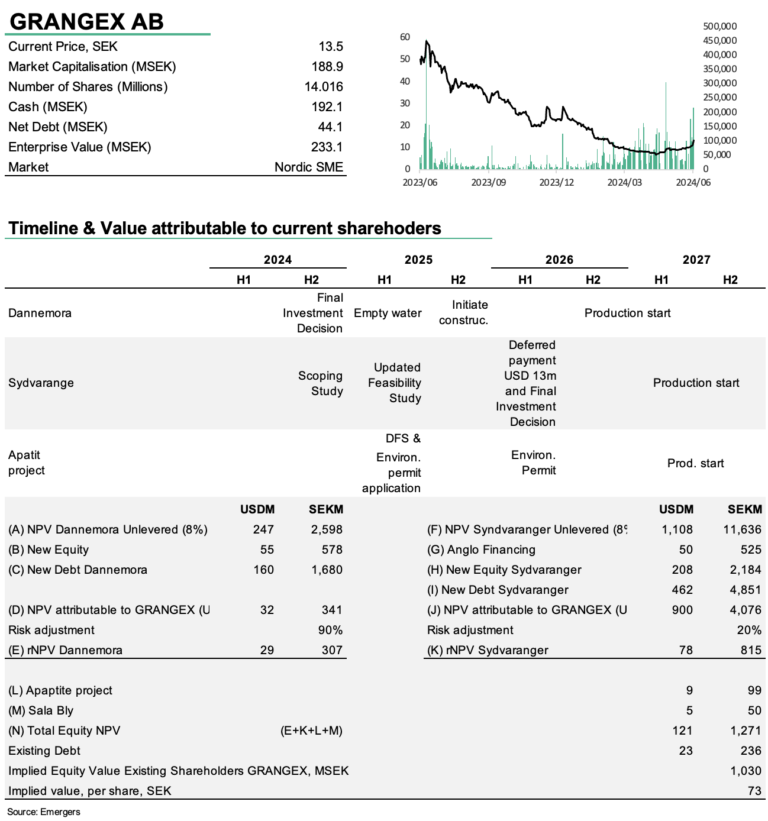

GRANGEX: Updated DFS confirming viability to produce high-grade iron ore at Dannemora

The announcement of the updated DFS for Dannemora showed, as expected, higher CAPEX and OPEX compared to the FS announced in December 2022, as a result of the general price increases seen in the past two years. Combined with the higher Iron Ore price, this meant only a slight adjustment of the Post-tax NPV (8%) from USD 205m in December 2022 to USD 200m now, thus confirming Dannemora’s technical and economic viability to be a producer of high-grade magnetite concentrate. In our model however, we find it reasonable to account for a price premium from 65% up to 68%, which supports a Post-tax NPV of USD 247m.

With a final project financing and investment decision as the next step, and a new plan for Sydvaranger, we see several triggers in the coming 12-24 months that should drive a revaluation of the share. Our NPVs include a high degree of uncertainty especially for Sydvaranger, but we now find support for a total rNPV-based fair value for today’s equity holders of SEK 73 (78) per share.

Minor adjustment of Post-tax NPV to USD 200m

The updated DFS has analyzed capital costs, operating costs and revenue on an annual basis over the full 13-year project life, comprising a 28-month pre-development period, followed by 11 years of mine production. In the updated DFS, Pre-tax NPV (8) is dialed down from USD 274m in Dec 2022 to USD 269m now, while Post-tax NPV is lowered from USD 205m to USD 200m. The new DFS also makes a slight upgrade of the OPEX per ton estimate, from USD 60.2 to USD 63.3 while accounting for a higher Iron Ore price in the model, from USD 129/t to USD 150/t and a higher Initial CAPEX from USD 178m to USD 215m.

With a post-tax IRR of 21.9%, and a payback period of 4.1 years from start of production, the updated DFS supports proceeding to the next stage of development and project financing. Then the start of the mine drainage is planned to begin as soon as the investment decision and full project financing are in place. As we now are already at summer and with the 28-month pre-development period in mind, we now see a clear risk that the production start might be further postponed into H1’2027.

USD 160/t model price for 68% iron ore

Current indices for high-grade concentrate (MB65 or Platts IODEX65) are forecast to be at an average level of USD 150/t, which is approximately USD 20/t above the 62% Fe index (i.e. with an additional USD 6-7/t per extra Fe-unit above 62%). Extrapolating the Fe-premium up to 68% will result in USD 170/t for the Dannemora product on CFR China basis. In order to establish the Oxelösund Port FOB price, long-term freight rates from Brazil to China, freight rates from Brazil to Dannemora’s customers and freight rates from Oxelösund Port are applied, resulting in a long-term average price for the Dannemora product of approximately USD 151/t on a CFR China basis. In our model we find we find it reasonable to account for a linear price premium from 65% up to 68%, but to also take volatility into account, we used a model Iron Ore price of USD 160/t.

Set for now, but major raise on the near term horizon

With SEK 45m in cash at the end of Q1’24, the USD 0.5m payment for Sydvaranger, USD 17.5m royalty payment from Anglo American of which USD 3m has gone to reduce debt, we now estimate cash before operational costs to date at around SEK 192m. While this may seem like a lot compared to the SEK 189m Market Cap, it should be noted that GRANGEX now has to carry USD 5m in annual care and maintenance costs at Sydvaranger since May 2024.

Along with the case in Dannemora that already offers good potential value for shareholders, we also include Sydvaranger into our rNPV calculation, although we highlight that uncertainty in this side of the model is considerably higher, at least until the company presents an updated Feasibility study. That being said, the first data points from Sydvaranger indicate an even greater potential than in the previous DFS (i.e. an NPV well above USD 550m) when raising the output from blast furnace concentrate to direct reduction iron ore, and accounting for significantly higher iron ore prices.

Key milestones for investors

As the updated DFS for Dannemora has now been published, we look forward to:

- Final investment decision and commencement of drainage of Dannemora in H2’24/H1’25

- updated DFS for Sydvaranger later in 2024

- the major capital raise slated for 2024

- Production start in Dannemora in 2026/27

- Final Investment Decision for Sydvaranger