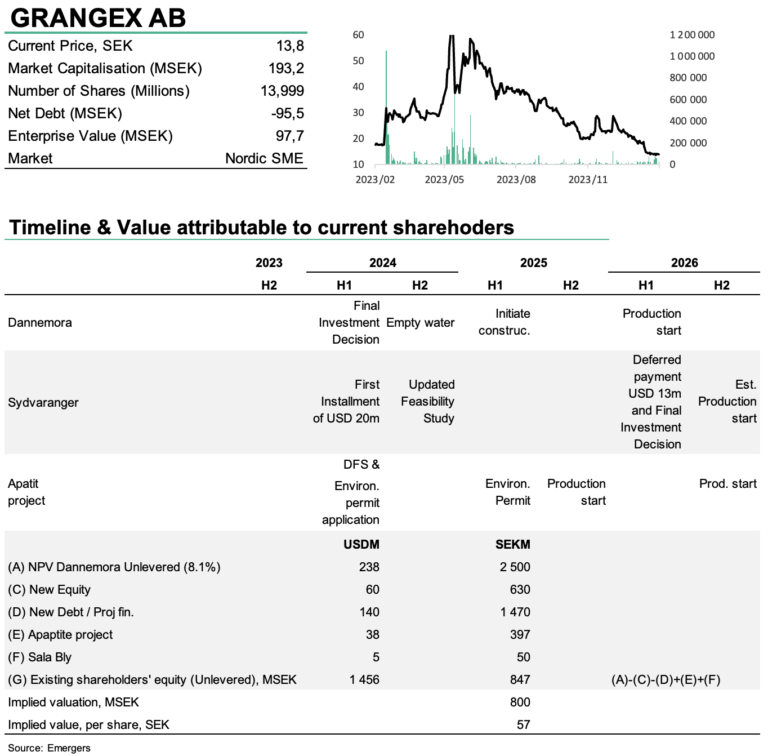

GRANGEX: Starting to fuel up: GRANGEX set for busy agenda in 2024

With the SEK 74 m (estimated 61m net) proceeds from the rights issue, we now look forward to the updated feasibility study initiated in December ‘23, the final project financing and investment decision for Dannemora, with subsequent commencement of drainage of the mine. For Sydvaranger, we await the updated Feasibility study, and the separate funding which will provide a fresh data point on valuation of Sydvaranger already in Q1’24, most likely exceeding parent company GRANGEX’ current market cap of SEK 190m. All in all, we find several triggers in the coming 12-24 months that are likely to drive a revaluation of the depressed share.

Outcome of the rights issue

The preferential rights issue of shares, which concluded on February 19, 2024, raised a total of approximately SEK 74.3m before issuance costs. 34% was subscribed with the support of subscription rights, about 1% without the support of subscription rights, while the remaining up to 92% was subscribed by the underwriters. The number of shares thus increases from 8,694,861 to 13,999,146 shares, resulting in a dilution of approximately 38 percent. Assuming that underwrites takes compensation in cash (14% and 16% resp.), we estimate the total issuance cost to approx. SEK 13.7m.

Busy agenda for both Iron ore projects in 2024

In Dannemora, an updated feasibility study was initiated in December, which will define the total CAPEX, and thus the total financing requirement. Project financing and investment decision are planned to be completed during Q2’2024. The start of the mine drainage is planned to begin as soon as the investment decision and full project financing are in place, which represents a slight delay compared to our previous expectations. As a consequence we now postpone our expected production start to H1’2026.

As for Sydvaranger, GRANGEX announced in late Q4’23, a royalty and off-take agreement with Anglo American of USD 5m + 12.5m for the part-funding and development of the Sydvaranger Mine. A first purchase price of 20 MUSD (of which 1 MUSD has already been paid) will be paid by GRANGEX no later than March 31, 2024, meaning that GRANGEX will need to raise additional capital to meet the price tag of USD 33m and the subsequent development expenses. A deferred purchase price of 13 MUSD will be paid by GRANGEX at the final investment decision to resume operations in Sydvaranger, currently at the beginning of 2026. GRANGEX will also take over the current operating and maintenance costs for Sydvaranger from January 1, 2024.

While the case in Dannemora already offers good potential for shareholders, we await the updated Feasibility study to include Sydvaranger into our NPV, but note that the first data points from Sydvaranger indicate an even greater potential than in the previous DFS (i.e. an NPV well above USD 550m) when raising the output from blast furnace concentrate to direct reduction iron ore, and accounting for significantly higher iron ore prices. Interestingly, the separate funding of subsidiary Sydvaranger will provide a fresh data point on valuation of Sydvaranger already in Q1’24, most likely exceeding parent company GRANGEX’ current market cap of SEK 190m.

Improving backdrop for Apatite project

In 2023, the political framework for phosphate mining in Sweden improved with the EU’s adoption of the Critical Raw Materials Act, which will be implemented in the legislation of all EU countries during 2024. In this legislation, raw phosphate is classified as a critical raw material, meaning that countries are required to extract 10 percent of their consumption from mines and recycle 25 percent. As GRANGEX’ apatite will be classified as recycled it is one of very few projects in Europe classified this way. We do however expect that it will be hard for the apatite project to compete with other portfolio projects for management’s time and resources in 2024.

Several milestones for investors to look forward to

After the short-term financing round now completed, we look forward to:

• The separate funding of Sydvaranger in Q1’24 which will provide a valuation of GRANGEX’ holding

• updated DFS and commencement of drainage of Dannemora in H1’24

• the major capital raise slated for 2024

• updated DFS for Sydvaranger later in 2024

• Production start in Dannemora in H1’26

• Final Investment Decision for Sydvaranger in H1’26