CRUNCHFISH: Major TAM expansion with broadening to secure and scalable mobile card payments

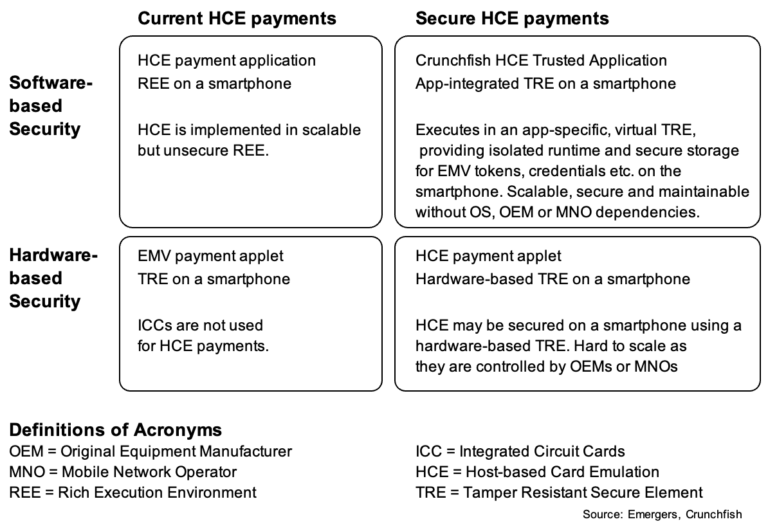

With the broadening of its Digital Cash technology to support secure Host-based Card Emulation (HCE) for online as well as offline, Crunchfish can now offer both secure and scalable mobile card payments. This expands Crunchfish’s total addressable market (TAM) manyfold as it offers to fill a blank spot in the Android/Google Pay ecosystem, as it addresses the tradeoff between security and scalability facing payment provides, banks, central payment systems and card companies today. Crunchfish's approach to HCE payments also enable novel use cases, like offline, scan and pay (QR) and P2P payments. For details on today’s announcement, please see the simplified structure of the implementation architectures of HCE payment applications below.

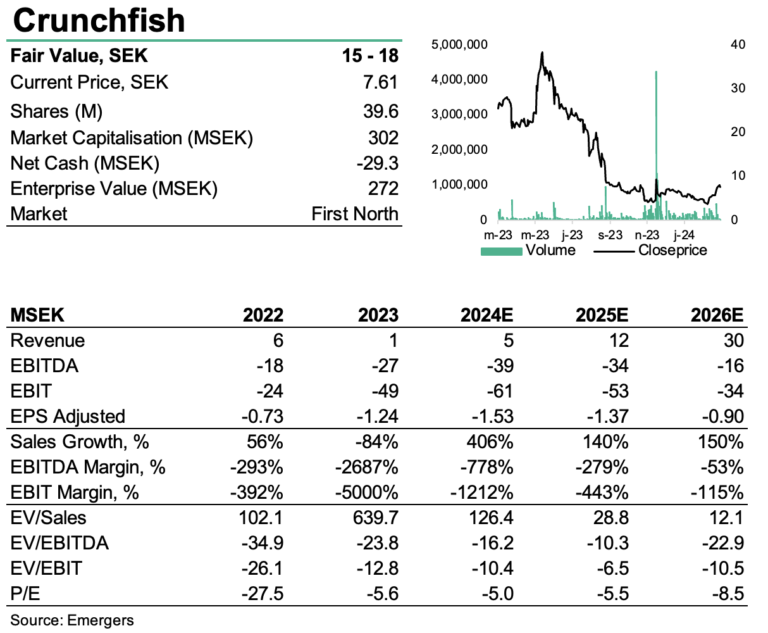

As a consequence of the increased potential customer and counterparty base, ranging from Google Pay, card companies, to payment systems, banks, central payment systems, and mobile operators, we see improved chances for one or more agreements. However, we continue to expect that all such will be preceded by some form of pilot, which is why the impact on revenues will come gradually. Following today’s announcement, we have adjusted our expectation for initial revenues up to SEK 5 million (2) in 2024E, although we also see a chance for considerably larger deals already this year.

While we continue to note that the company’s cash reserves will need to be replenished before the end of the year, we view the surge in the stock price, with a doubling just in March, as a sign that the valuation has reached some sort of local bottom. As the investment case now seems just a tad less binary, we now find support for a fair value of SEK 15-18 (13-16) per share. Also, the structural process with EY Corporate Finance, which includes the divestment of Gesture Interaction, adds a potential catalyst to the case.