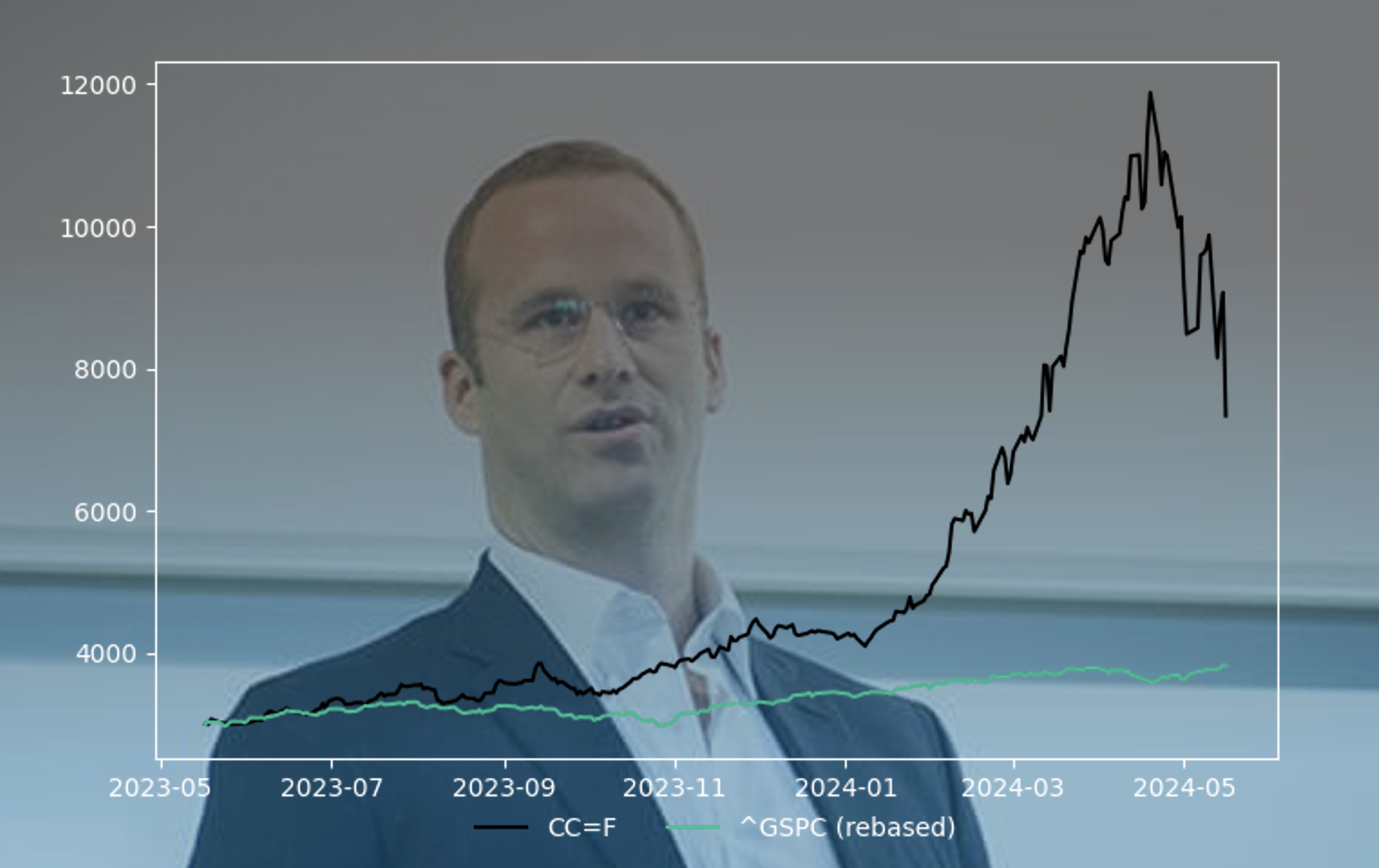

Perfect storm in cocoa continues: Brace for a new price surge

Despite a 40% pullback in the parabolic cocoa rally, hedge fund manager Pierre Andurand believes cocoa has another leg up to go. Several structural factors with near-term impact, combined with a 10-year replant cycle and a technically appealing setup, suggest he will likely be right.

Although Cocoa has come down from its parabolic run, the fundamentals haven't changed, and the 40% pullback now leaves room for another cocoa rally. In fact, we find several fundamental and structural factors with both long and near-term impact on prices. And with cocoa futures in backwardation and a technically tempting level, we find it unlikely for cocoa prices to stay at current levels.

It is now widely accepted that the current significant decline in production from the two leading producers has spurred the ongoing prices hikes. With Côte d’Ivoire and Ghana accounting for approximately 54% of global production, any issue with their production will ultimately have an impact on global supplies and prices. That we can read from International Cocoa Organization (ICCO) statistics.

Cocoa futures prices in Backwardation

For both the London and New York markets, the nearby contracts (JUL-24 at $7,334) are in backwardation as their prices are higher than the deferred contract month (DEC-24 at $6,237). The current backwardation structure of the cocoa market continues to underscore the supply challenges and consequent high prices.

It is also important to note that 80% to 85% of the production for this season had already been harvested in March since the main crop was coming to an end. As a result, chances of the mid-crop reversing the current market deficit are very slim.

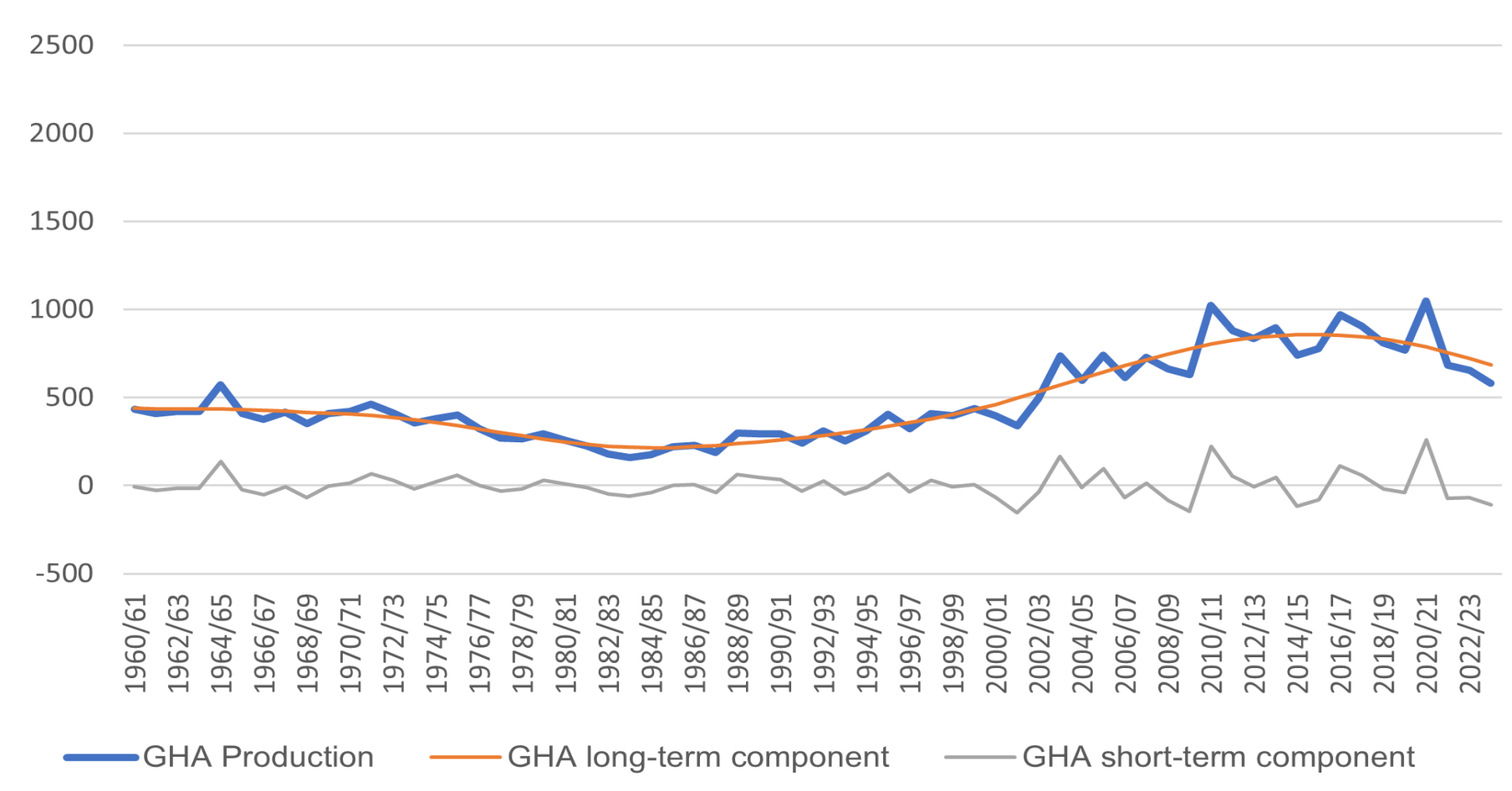

Production decline a structural change?

Cocoa production in Côte d’Ivoire and Ghana has decreased by 467,000 tonnes and 448,0000 tonnes respectively over the past three seasons and has equally contributed to the current shortfall in the world cocoa production.

A short- and long-term analysis conducted by the Secretariat shows that Ghana’s production deficit appears to be structural in nature. In fact, a long-term negative trend appears to have started in 2016/17. This is due to a combination of negative events: