AI boom about to create bottleneck in HBM chips, where Nvidia's supplier SK hynix holds a 60% market share. Here’s how it will triple earnings

This will result in mid-single-digit P/E by 2025-26e. Here’s how.

This will result in mid-single-digit P/E by 2025-26e. Here’s how.

High Bandwidth Memory (HBM) chips have become vital components in the race to build more powerful AI, since these models require memory chips that can store and release data quickly.

🤖 HBMs are designed to speed up the process by integrating a stack of memory chips together with the logic chips.

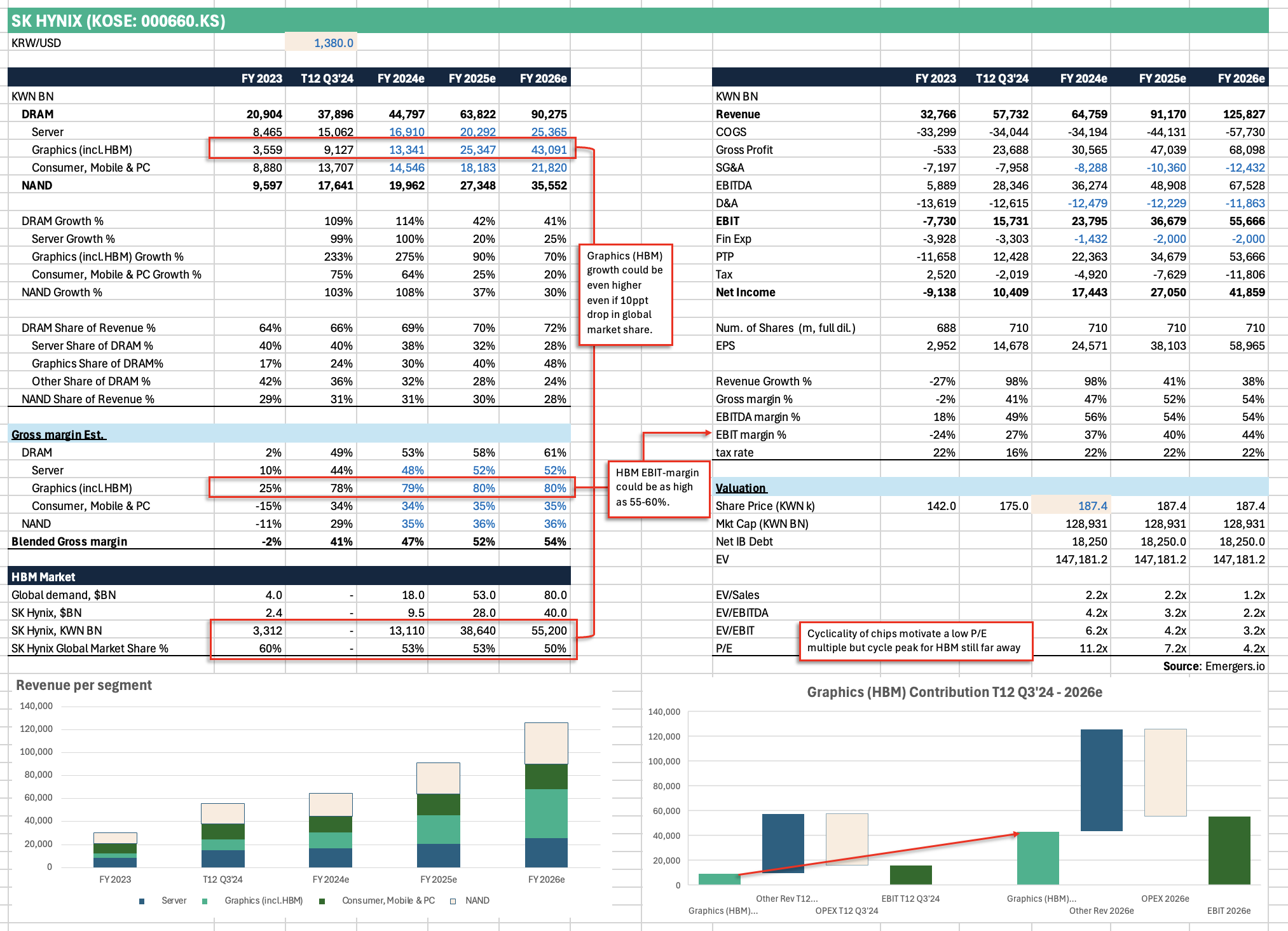

🤖 Global HBM sales have increased from $4BN in 2023 and are expected to reach $18BN this year and $81BN in 2026, according to Arete Research.

🤖 SK Hynix holds a 60% global market share in HBM, and 90% in market share in the most advanced HBM3.

🤖 SK Hynix will start shipping HBM3E 12Hi in Q4'24, and expect 12Hi share to exceed half of total HBM3E shipments during 1H’25.

🤖 Fixed costs for HBM are around 2.75x that of standard DRAM. But Gartner estimates that the average price per gigabyte (GB) of HBM and standard DRAM is approximately $10.6 and $2.9, respectively.

🤖 With estimates of gross margin for HBMs above 80%, EBIT-margin for HBMs could be 55-60%, making the strong growth in HBMs a significant driver for group profits in 2024-2026e.

🤖 SK Hynix's stock price surpassed 240,000 won in mid-July but has since declined due to concerns over an AI bubble and the weakness of global tech stocks.

🤖 Chips are however a highly cyclical business as evidenced by the downturn in 2023.

This is not financial advice. Let me know if you want the excel.